Unfortunately, most insurance companies do not provide coverage for life flight insurance or air ambulance service, leaving individuals and their loved ones burdened with the cost of emergency airlifting after an accident. If you or someone you know had to be airlifted after an accident you should contact a personal injury lawyer right away.

Insurance companies are business first and typically will avoid paying any bills they don’t have to which can put a tremendous financial burden on injury victims including bills from the life flight network.

3,600,000 Serious Injury Accident Settlement

Air Ambulance May Not Be Included In Your Insurance Policy

According to the Association of Air Medical Services, more than 550,000 people receive airlift services every year in the U.S.

While some are pre-planned and coordinated to transport patients between medical facilities, the majority of airlift situations are due to accidents and emergencies.

Insurance coverage for life flights may be deemed medically necessary based on the availability of specialized care in a particular medical facility.

Many people who have coverage through their employer, a self-insurance plan, Medicare, or Medicaid may assume that these services are included in their policy.

It comes as a shock when they receive a bill and must pay out-of-pocket because their claim for an airlift is denied by an insurance representative.

However, there may be many factors that determine your entitlement, or lack of it, so don’t accept a denial at face value.

Here are some reasons why you should contact a knowledgeable insurance disputes lawyer when your medical insurance won’t cover the cost of your airlift.

What is the Average Cost of Air Medical Transport?

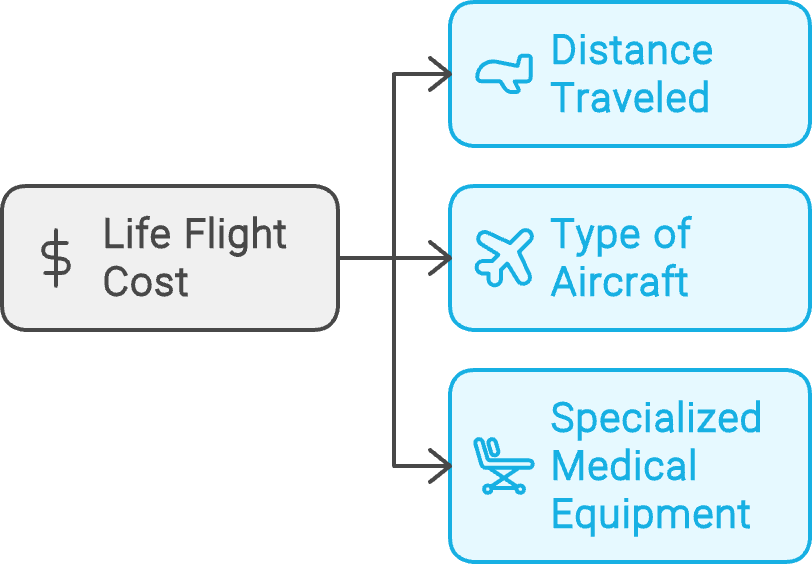

The average cost of a life flight in the US is between $12,000 and $25,000. The air ambulance cost can vary significantly based on factors such as distance traveled, type of aircraft used, and specialized medical equipment required.

Did a loved one require a flight for life?

See if you might have a personal injury case. Insurance coverage for life flights often depends on whether the service is deemed medically necessary in the event of a serious medical emergency. It’s completely free, with no obligations.

At GJEL, we can help you maximize the value of your case, ensure you receive the proper medical attention, and hold wrongdoers accountable.

Insurance Companies are Businesses First

You may pay your premiums regularly, and thus expect proper customer service from your insurance company. Still, an insurance company is a business first and foremost.

These companies are motivated to maximize profits and minimize losses, and your claim for the cost of an airlift may be viewed by your insurer as another potential disputed item. They may deny your claim for airlift because they do not expect much of a fight if you do not have a lawyer, leaving you with significant out-of-pocket costs even with health insurance.

Insurance Representatives Do Not Work for You

The National Association of Insurance Commissioners reports that the average cost for one air ambulance flight is between $12,000 and $25,000. Insurance companies often examine the circumstances of the airlift to determine if they will cover air ambulance services. Insurance companies often do all they can to avoid payment of a claim for this high amount, so they frequently put their best claims employees on these matters.

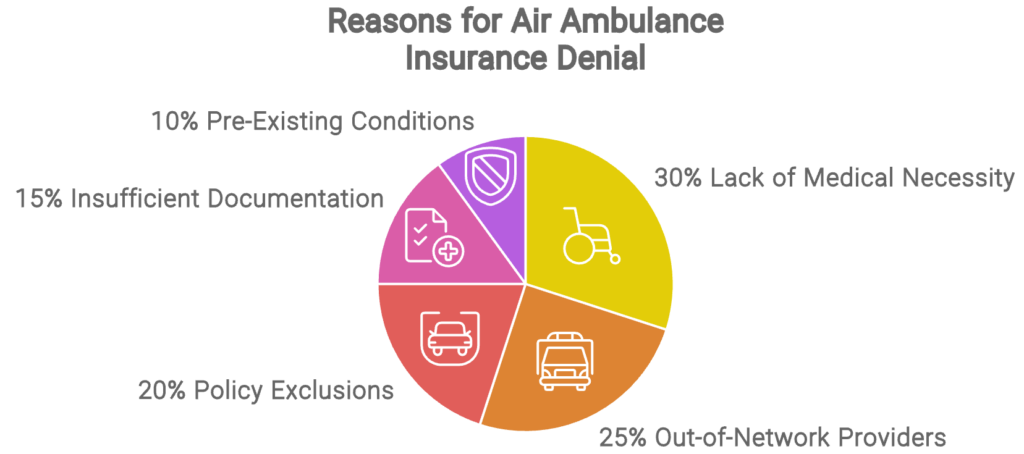

Even though they are not attorneys, insurance company representatives have experience and in-depth knowledge of the law. They may seek loopholes, assert that the transportation was not medically necessary, or find other reasons to find that an airlift is not covered. You are at a disadvantage unless you have a lawyer to fight for your rights.

How much does a life flight cost without insurance?

The cost of a Life Flight with insurance can vary depending on a number of factors such as the type of insurance coverage you have and the specific terms of your policy.

The high costs associated with air medical transport can be a significant financial burden without insurance coverage. Generally, Life Flight services can be quite expensive, ranging from several thousand dollars up to tens of thousands of dollars.

However, if you have insurance that covers Life Flight services, your out-of-pocket costs may be significantly reduced. Many insurance plans cover at least a portion of the cost of Life Flight services, and some plans may cover the entire cost.

To find out exactly how much you would pay for a Life Flight with insurance, it’s best to consult with your insurance provider. They can provide you with detailed information about your coverage and any out-of-pocket costs you may incur. It’s important to remember that if you are in an emergency situation and require Life Flight services, your health and safety should always be your top priority, regardless of the cost.

How much is life flight without insurance depends on your individual carrier.

How much does a life flight cost with insurance?

Unless you have specific coverage for life flights you may be responsible for life flight fees. The high costs associated with air medical transport services make it essential to have specific coverage for these services. There are also separate life time policies you can get that will cover air ambulance flights if purchased before the need arises.

An Attorney has the Legal Experience and Knowledge to Protect Your Rights

A lawyer with experience in insurance disputes knows the laws that protect you from potential misconduct by insurers. In California, insurance companies have a legal duty to act in good faith in processing your claim and in settlement discussions. Failure to do so can be bad faith, for which insurance providers can be liable. You may be entitled to compensation if the insurer’s refusal to pay for your airlift claim involves:

An unjustified denial;

Refusing to pay before proper investigation;

Not paying the claim within a reasonable time period;

Failure to attempt to settle or offering substantially less than what the claim is worth;

Refusing to participate in settlement discussions;

Failure to provide a reasonable, supportable explanation for denial of the claim; and,

Many other like examples of misconduct.

Consult with an Experienced Accident & Injury Lawyer

For more information on bad faith and other tactics an insurance company may use to avoid payment of your airlift, please contact GJEL Accident Attorneys. Our lawyers have extensive experience protecting the rights of insured individuals, and we will fight for your rights when confronted with misconduct.

To schedule a free consultation, please contact our firm by calling (925) 253-5800 or toll-free at 1-855-508-9565.

What is Life flight cost without insurance? How Much Is It?

Air ambulance (life flight) costs are highly variable and depend heavily on distance, urgency, and necessary medical equipment. The cost factors associated with a medical flight include the types of aircraft and specialized medical equipment required. However, the average cost in the U.S. falls into the $12,000 to $25,000 range. Factors that can dramatically raise the price include:

Long Transport Distance: More fuel and crew hours needed.

Specialized Medical Needs: Advanced equipment and highly-trained personnel are more costly.

Lack of Insurance Coverage: Many insurance plans provide limited or no coverage for air ambulances.

Typically you will have to pay out of pocket. However if the accident was the result of the negligence of someone else, GJEL can help you maximize your recovery and get the settlement dollars you deserve.

Visit An Office Nearby

Sources