If you’re facing an overwhelming air ambulance bill after a serious injury, you’re not alone. At GJEL Accident Attorneys, we understand the stress and financial burden this situation can create.

We’ve successfully reduced many air ambulance bills and helped numerous victims get compensation for accidents that weren’t their fault.

Our experienced team is here to guide you through this challenging time, allowing you to focus on what’s most important – your family’s healing and recovery.

Don’t let the weight of medical bills add to your stress. Contact GJEL Accident Attorneys today at 415-986-4777 for a free case review. Let us help you get your life back to normal.

Understanding Your Air Ambulance Bill

Air ambulance services, while often life-saving, can come with staggering costs that catch many patients off guard.

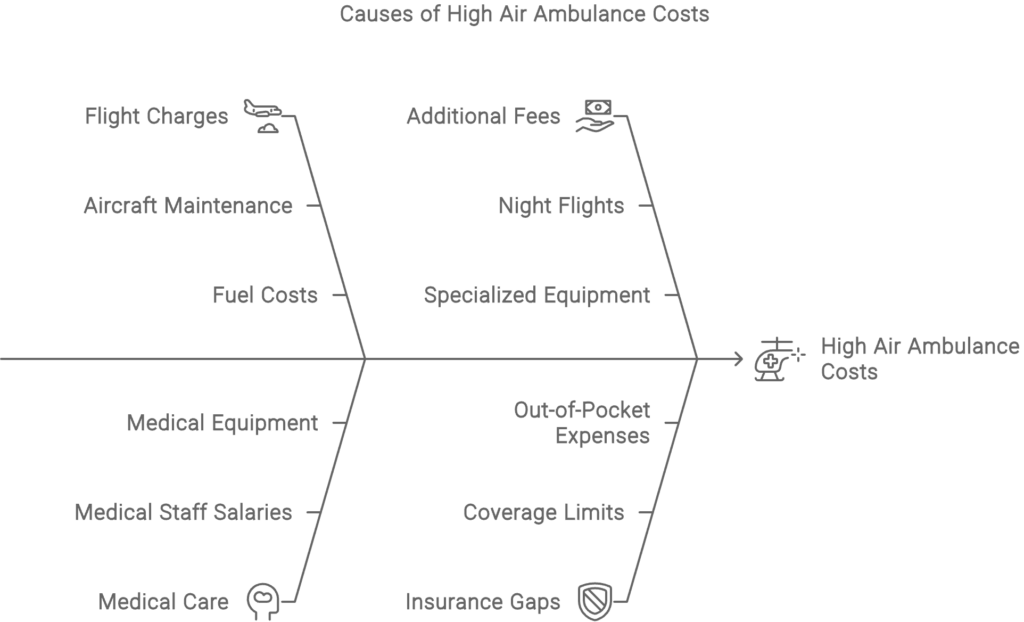

These bills typically include charges for the flight itself, medical care provided during transport, and sometimes additional fees for things like night flights or specialized equipment.

The high costs are often attributed to the expensive nature of maintaining and operating aircraft, as well as the need for specialized medical staff and equipment.

It’s important to note that there’s often a significant gap between what insurance companies are willing to pay and the actual billed amount, leaving patients with substantial out-of-pocket expenses.

Learn more about if insurance will cover your flight for life.

Typically air ambulance flights come from a catastrophic injury. If you or someone you were loved in a catastrophic injury it’s important to contact a personal injury attorney to discuss your options.

Immediate Steps After Receiving the Bill

- Upon receiving an air ambulance bill, it’s crucial not to panic, despite the likely shock at the amount due.

- Your first step should be to carefully review the bill for accuracy, checking for any potential errors or duplicate charges.

- Next, contact your insurance company to understand what portion of the bill they will cover and why.

- It’s also advisable to request an itemized bill from the air ambulance provider, which can help you better understand the charges and potentially identify areas for negotiation or dispute.

Exploring Payment Options

There are several avenues to explore when it comes to managing your air ambulance bill. Start by negotiating with the air ambulance company directly – many are willing to offer discounts for prompt payment or may have financial assistance programs available.

Setting up a payment plan is another option that can make the bill more manageable over time. While medical credit cards or loans might seem tempting, approach these options with caution as they often come with high interest rates.

Some patients have found success with crowdfunding campaigns, though this option depends on your comfort with sharing your story publicly.

Insurance Considerations

Understanding your insurance policy’s coverage for air ambulance services is crucial. If your claim has been denied, don’t hesitate to file an appeal – insurance companies often reverse their decisions upon review.

It’s also worth exploring whether you have any secondary insurance options that might help cover the remaining balance. Remember, insurance policies can be complex, and it’s often beneficial to have an experienced attorney review your coverage and advocate on your behalf.

Legal Options and Working with an Attorney

In many cases, working with an attorney can significantly improve your chances of reducing or eliminating your air ambulance bill. At GJEL Accident Attorneys, we have extensive experience negotiating with air ambulance companies and insurance providers.

We can help determine if your air ambulance costs can be included in a personal injury claim, potentially shifting the financial burden to the responsible party.

Our team will review your case, explain your options, and fight tirelessly to protect your rights and financial well-being.

Prevention and Future Planning

While it’s impossible to predict when air ambulance services might be needed, there are steps you can take to be better prepared.

Start by reviewing your current insurance policy to understand your coverage for air ambulance services. Some people choose to enroll in air ambulance membership programs, which can provide coverage in exchange for an annual fee.

It’s also important to understand when air ambulance services are typically deemed necessary, as this knowledge can help you make informed decisions in emergency situations.

Should You Pay For An Air Ambulance Bill Out of Pocket?

Dealing with an air ambulance bill can be overwhelming, but remember, you have options.

From negotiating with providers to exploring legal avenues, there are multiple ways to address this financial burden. At GJEL Accident Attorneys, we’re committed to helping you navigate this challenging situation.

Our experienced team can provide the guidance and support you need to focus on your recovery, not your medical bills.

Don’t face this challenge alone. Contact GJEL Accident Attorneys at 415-986-4777 for a free case review. Let us help you get the compensation you deserve and put this stressful chapter behind you. Your recovery and peace of mind are our top priorities.